How Is A Buyer's Responsiveness To Price Changes Measured

The following points highlight the top five methods used for measuring the elasticity of need. The methods are: 1. Toll Elasticity of Need 2. Income Elasticity of Demand 3. Cross Elasticity of Demand 4. Advertizing or Promotional Elasticity of Sales v. Elasticity of Toll Expectations.

Method # one. Price Elasticity of Demand :

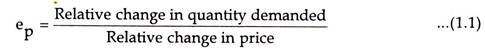

Price elasticity of demand is a measure of the responsiveness of demand to changes in the commodity's ain price. It is the ratio of the relative modify in a dependent variable (quantity demanded) to the relative change in an independent variable (Price). In other words, toll elasticity is the ratio of a relative change in quantity demanded to a relative change in price. Allow 'eastward' stand for elasticity.

Then:

Likewise, elasticity is the pct change in quantity demanded divided by the percent in cost.

Symbolically, nosotros may rewrite the formula:

![]()

If percentages are known, the numerical value of elasticity can be calculated. The coefficient of elasticity of demand is a pure number i.e. information technology stands by itself, being contained of units of measurement. The coefficient of toll elasticity of need can be calculated with the help of the post-obit formula.

![]()

Where,

Q is quantity, P is cost, ΔQ/Q relative change in the quantity demanded and ΔP/P Relative alter in price.

It should be noted that a minus sign (-) is generally inserted in the formula before the fraction with a view to making the coefficient of elasticity a not-negative value.

The cost elasticity can be measured betwixt two finite points on a demand curve (called arc elasticity) or on a point (chosen signal elasticity).

Arc Elasticity:

Any 2 points on a demand curve make an arc. In the words of Baumol, "Arc elasticity is a measure of the boilerplate responsiveness to price changes exhibited by a demand curve over some finite stretch of the curve". The measure of elasticity of demand between any two finite points on a need curve is known as arc elasticity.

The elasticity coefficient can be calculated with the help of the post-obit formula:

![]()

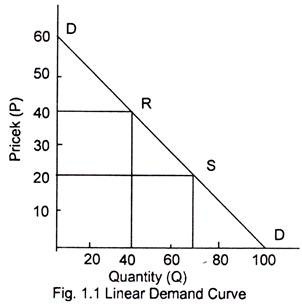

For example, in Fig. ane.ane two finite points R and Southward are taken to measure out the arc elasticity. Get-go we move to measure elasticity for a autumn in the toll of the article from Rs. 40 to twenty. ΔP is forty – twenty = 20. This decrease in toll causes an increase in demand from 40 units to 70 so that ΔQ is forty – 70 = – 30.

These values tin be put in the formula and so that:

![]()

This implies that a i percent fall in toll of article X causes a 1.5 per cent increase in demand for it.

In the measurement, estimation and utilize of arc elasticity, the business executives need have adequate intendance every bit the elasticity coefficient may differ depending upon the management of movement. In this case nosotros take measured the elasticity coefficient while moving downwards from betoken R to South.

The coefficient will exist different while moving upward from point South to R (increment in price from Rs. 20 to 40 and quantity demanded is reduced from 70 to 40 units giving an elasticity coefficient of – 0.42 implying that one per cent increment in price will reduce the quantity by 0.42 percentage. Thus the elasticity depends on the management of change in price. Therefore, measuring elasticity through arc method, the direction of price modify should exist kept in mind.

The way out of this difficulty is to take an average of prices and quantities and thus to measure elasticity at the midpoint of the arc.

The formula then becomes:

![]()

Although the ½ cancels out in the formula, it is put there to stress the fact that by using the average values of the quantities and prices, the elasticity coefficient is the same whether cost goes upwards or goes down.

Betoken Elasticity on a Linear Demand Curve :

Betoken elasticity is the ratio of an infinitesimally small relative change in quantity to an infinitesimally small change in price. If a toll range is made every bit pocket-sized as possible, that is, shrunk to a point- then the relative changes must be made as modest as possible- infinitesimally pocket-size.

Point elasticity is the ratio of an infinitesimally small relative alter in quantity to an infinitesimally small modify in price. Point elasticity of demand is defined as the -proportionate modify in the quantity demanded resulting from a very small-scale proportionate change in price. Fig. i.2 shows how to find the elasticity at a point on a demand curve.

Permit united states take a indicate such equally R on the demand bend DD. For measuring elasticity at a point the following formula may be used.

![]()

Bespeak elasticity is the production of price-quantity ratio (P/Q) at a detail point (R) on the need curve (DD) and the reciprocal of the slope of the demand line. The slope of the demand gradient is divers by RQ/QD. The reciprocal of the slope of the demand line is QD/RQ.

![]()

At indicate R, toll P = RQ and Q = OQ

If we substitute these values in equation 1.eight, what nosotros get is

![]()

If the numerical values for QD and OQ are bachelor, elasticity at point R can exist calculated.

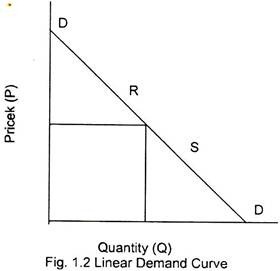

Price Elasticity at Dissimilar Points on a Non-Linear Demand Curve :

The method used to mensurate point elasticity on a linear demand bend cannot be applied straightway to measure indicate elasticity on a non-linear demand bend. In guild to measure signal elasticity on a non-linear need curve, nosotros commencement draw a tangent to the selected signal and bring it on a linear need curve. Fig. 1.3 illustrates how we can measure out point elasticity on a non-linear demand bend at indicate R.

For this purpose, we draw a tangent AB through point R. Since demand curve DD and the line AB pass through the aforementioned point R, the slope of the need curve and that of the tangent is the same. Therefore, the elasticity of need bend at betoken R will be the aforementioned every bit the elasticity on point R on line AB. The formula applied to mensurate the elasticity on a linear demand curve can at present be used as the not-linear demand bend has been changed into a linear demand curve.

Price Elasticity and Total Revenue :

One important awarding of elasticity is to clarify whether a toll increase will enhance or lower total revenue. Many business executives are concerned with the upshot whether it is worthwhile to raise prices and whether the higher prices make up for lower demand.

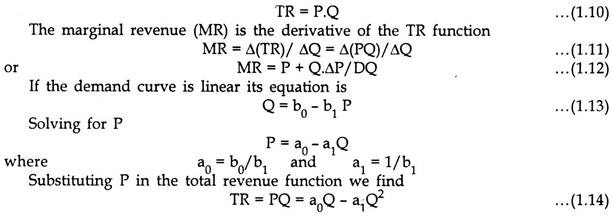

Full acquirement is equal to toll times quantity (TR = P.Q).

If we know the price elasticity of demand, nosotros may know what will happen to total revenue when cost changes:

(i) If price elasticity (ep > i), reducing the toll volition increase the total revenue.

(two) When need is perfectly inelastic ep = 0, there is no decrease in quantity demanded when price is raised. Therefore, a ascension in price increases the total revenue and vice versa.

(3) In case of an inelastic need (ep < i), the total acquirement falls when the toll is decreased. The total revenue increases when the price is increased.

(4) When the need for a product is unitary elastic (ep = 1) quantity demanded increases or decreases in the proportion of increases or subtract in the toll. Hence full revenue remains unaffected.

To make this point more than clear, we require total and marginal revenue role and price-elasticity of demand.

The MR is then

MR = Δ(TR)/ΔQ = a0 – 2aaneQ … (1.15)

Information technology tin can be seen from the effigy 1.4 that if the demand curve is falling the TR curve initially increases, reaches a maximum, so starts declining. The derived relationship between MR, P and east can be used to establish the shape of the full- revenue curve.

The total revenue curve reaches its maximum level at the point where eastwardp = one, considering at this bespeak its slope, the marginal acquirement, is equal to goose egg.

MR = P (1 – 1/1) = 0

If ep >1 the total revenue curve has a positive slope. Information technology is all the same increasing and has not reached its maximum signal. If ep <one the full-revenue has a negative slope and is falling.

The following can be summarized:

1. If the ep < 1, the demand is inelastic, an increment in price leads to an increase in total revenue, and a subtract in price leads to a fall in total revenue.

2. If eastwardp > 1, the need is elastic, and increase in price volition cause a subtract in the full revenue and a subtract in toll will lead to an increase in the total revenue.

3. If eastp = i, the demand is unitary rubberband, total revenue is not afflicted by changes in price because MR has reached nada.

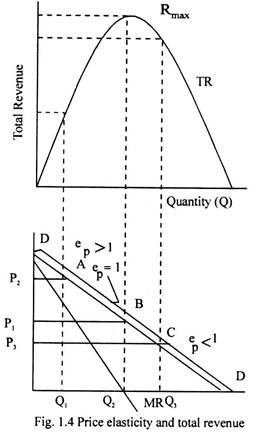

Price Elasticity and Marginal Revenue :

Demand and marginal revenue curves show where demand is elastic, unitary elastic and inelastic. It is clear that demand becomes less elastic at lower prices. This is a characteristic of linear demand curves considering the bend is linear dQ/dP is a constant. Thus price elasticity is determined by the value of P/Q. But as cost decreases, P/Q also decreases.

Consequently, the absolute value of e becomes smaller and need becomes less elastic.

The figure one.v illustrates that the bespeak of unitary elasticity corresponds to the point where the marginal revenue crosses the quantity centrality. The marginal revenue is nada where demand is unitary elastic. Unitary elasticity means that a 1 percent increase in price causes quantity demanded to subtract past 1 percent and the increase in price is exactly start by the decrease in quantity demanded. Consequently, there is no modify in total revenue as the marginal revenue is zero.

The marginal revenue is positive where need is elastic and negative when demand is inelastic. Note that these relationships are likewise true for nonlinear demand curves. The betoken where marginal acquirement is zero always divides the elastic and inelastic regions of the demand curve.

In example of a vertical need curve, quantity demanded is not affected by changes in price as dQ/dP is zippo and price-elasticity is also zero. For a horizontal demand curve, quantity demanded is highly responsive to changes in price every bit even a very pocket-size modify in toll can lead to an infinitely big change in quantity demanded as dQ/dP and toll elasticity being infinite. Horizontal demand curves are said to exist infinitely elastic. The cases of infinitely rubberband or completely inelastic demand curves are rare to observe in existent life, but an agreement of these is useful for economic assay.

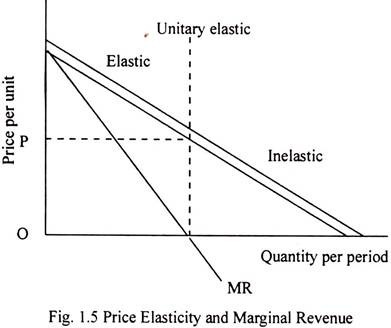

Method # ii. Income Elasticity of Demand :

The responsiveness of quantity demanded to changes in income is called income elasticity of demand. With income elasticity, consumer incomes vary while tastes, the commodity's own price, and the other prices are held abiding.

The income elasticity of demand for a adept or service may be calculated by the formula:

where- ey stands for the coefficient of income elasticity, Y for income.

Whereas price-elasticity of demand is e'er negative, income-elasticity of need is always positive (except for inferior appurtenances) every bit the relationship between income and quantity demanded of a product is positive. For inferior appurtenances the income elasticity of need is negative because as income increases, consumers switch over to the consumption of superior substitutes.

The degree of income elasticity varies in accordance with the nature of commodities:

one. In case of all normal appurtenances, the income elasticity is positive

ii. For essential goods, the income elasticity is less than one. This means that quantity demanded increases less than proportionately as income increases. Soap, common salt, friction match, newspapers have low income- elasticity of demand.

3. For goods of comfort, the income-elasticity coefficient is equal to unit which results in proportionate change in quantity demand.

4. Luxury goods have income elasticity greater than unity implying more than proportionate change in quantity demanded. Jewelry, automobiles are goods of this category.

Income elasticity of demand can be useful in the following business decisions:

1. Income-elasticity can exist helpful in production planning and direction in the long run, particularly during the period of business concern cycle.

ii. It tin can exist used for demand forecasting with given rate of increase in income.

Income Sensitivity :

The income elasticity of need measures the degree of responsiveness of concrete quantities of consumption of a expert as income changes. If nosotros measure out consumption by consumer expenditures rather than by physical quantities of a good, the phenomena may be described every bit income sensitivity. An income- sensitivity may be defined as the percentage modify in expenditures on a proficient divided by the percentage change in income of the consumers.

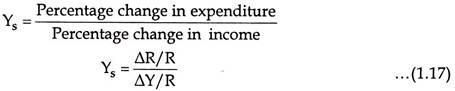

The income sensitivity may be measured with the help of post-obit formula:

where: Ys measures the income sensitivity, ΔR measures change in consumer expenditure and ΔY measures change in income.

Suppose a 10 percent increase in income causes consumer expenditure on a good to increase by 12 pct, the income sensitivity of that expert is 1.2.

Method # 3. Cross Elasticity of Demand :

Need is also influenced past prices of other goods and services. The cross elasticity measures the responsiveness of quantity demanded to changes in toll of other goods and services. Cross elasticity of demand is defined as the percentage change in quantity demanded of 1 skillful caused by a 1 percent change in the price of another practiced.

![]()

Cross elasticity is used to classify the relationship between goods. If cantankerous elasticity is greater than zero, an increment in the price of y causes an increase in the quantity demanded of x, and the two products are said to exist substitutes. When the cross- elasticity is greater than goose egg, the goods or services involved are classified as complements Increases in the toll of y reduces the quantity demanded of that product. Macerated demand for y causes a reduced demand for x. Bread and butter, cars and tires, and computers and computer programs are examples of pairs of goods that are complements.

The coefficient is positive if A and B are substitutes considering the toll change and the quantity change are in the same direction. The coefficient is negative if A and B are complements, considering changes in the toll of one commodity cause opposite changes in the quantity demanded of the other. Other things such every bit consumer sense of taste for both bolt, consumer incomes and the cost of the other commodity are held abiding.

Many companies produce several related products. Where a company'due south products are related, the pricing of 1 good can influence the need for other products. Gillette makes both razors and razor blades. Ford sells several competing makes of automobiles. Gillette probably volition sell more than razor blades if it lowers the cost of its razors.

The closer two commodities are as substitutes for each other, the greater is the size of the cross elasticity coefficient. Close substitutes accept high cantankerous elasticity of need; poor substitutes take low cantankerous elasticity.

In general, a ascension in the price of a commodity increases the demand for its substitutes and diminishes the demand for its complements.

Method # iv. Advertizing or Promotional Elasticity of Sales :

The advert expenditure helps in promoting sales. The touch on of advert on sales is not uniform at all level of total sales. The concept of advertising elasticity is significant in determining the optimum level of advertisement outlay particularly in view of competitive advertising past rival firms. An advertising elasticity could be divers as the percentage modify in quantity demanded for a percentage change in advert. Advertising might be measured by expenditure.

Advertising elasticity may be measured by the post-obit formula:

![]()

where: S = sales; ΔS= increase in sales; A = initial advertizement outlay; and ΔA = increased advert outlay.

The advertising elasticity of sales varies between zero and infinity. If advertising elasticity is zilch, sales do non answer to the advertising expenditure. Promotional elasticity coefficient greater than zero but less than 1 (eastwardA>0<i) indicates that sales increase less than proportionate to the increase in advertisement expenditure. The coefficient of equal to i ways proportionate increase in sales to the increase in expenditure on advertisement. If eA > one it interprets that sales increase at a higher charge per unit than the rate of increase of advertising expenditure.

Determinants of Advertising Elasticity :

1. The Level of Sales:

The advertizing elasticity of sales, particularly in instance of products newly introduced into the market place, is greater than unity. Sales increase more than proportionately with the increase in advertizing expenditure. As sales increase elasticity begins to subtract. Now the advertisement is done to create new customers to the product. Therefore, need now increases less than proportionately to increase in advert.

two. Competitive Advertising:

The advertizement elasticity of a firm will depend non only on the advertisement expenditure incurred by the firm for its product but as well on the effectiveness of the competitive advertising by the rival firms

3. Cumulative Consequence of By Advertizing:

In the initial stages the advertisement outlay is not adequate plenty to be effective. Therefore, the elasticity may be very low. Only in later stages equally the cumulative effect of advertisement assemble, the advertising elasticity may increase over time.

Alter in product's price, consumer'southward income, increase in the number of substitutes and their prices are other factors that influence the advertising elasticity of a product.

Method # 5. Elasticity of Price Expectations :

People's price expectations also play a meaning role equally a determinant of demand. J.R. Hicks, the English economist, in 1939, devised the concept of elasticity of cost expectations. The elasticity of price expectations may be defined as the ratio of the relative change in expected future prices to the relative alter in current prices.

![]()

![]()

where,

Pc Electric current prices

Pf Future prices

If ex > 1 Buyers wait that future prices will ascent by a larger percentage than current prices.

eastwardten = 1 Buyers look that future prices will ascension by the same percentage as current prices.

due eastx < one Buyers await that future prices will rise past a smaller per centum than electric current prices.

ex = 0 Buyers expect current ascent to have no outcome on futurity prices

eten < 0 Buyers expect that current ascension will exist followed by a fall in hereafter prices.

The concept of elasticity of price-expectation is very useful in formulating pricing policy.

Source: https://www.economicsdiscussion.net/elasticity-of-demand/measurement-elasticity-of-demand/how-to-measure-the-elasticity-of-demand-top-5-methods-economics/29500

Posted by: davisandessaint.blogspot.com

0 Response to "How Is A Buyer's Responsiveness To Price Changes Measured"

Post a Comment